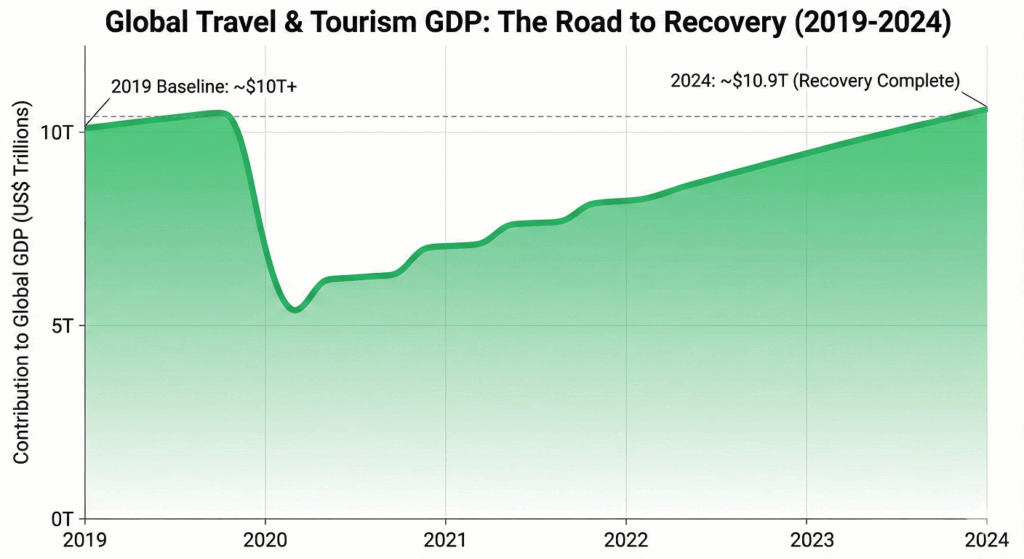

Global travel and hospitality industry revenue bounced back strongly between 2019 and 2024, driven by surging demand for leisure travel, stronger hotel performance and rising short-term rental activity. In fact, according to the World Travel & Tourism Council Travel & Tourism’s total contribution to global GDP reached roughly US$10.9 trillion in 2024, roughly back to — or slightly above — the 2019 level.

Headline figures at a glance

First, the essentials you should remember: total sector contribution to global GDP recovered to about US$10.9 trillion in 2024. Next, international tourist arrivals climbed to roughly 1.4 billion overnight visitors in 2024. Finally, hotels regained ground with RevPAR and ADR improving in many markets.

Looking at the trend, revenues plunged in 2020 then recovered stepwise from 2021 through 2024. For example, WTTC’s datasets show a steep fall in 2020 and steady growth afterward, culminating in near-2019 or slightly higher totals by 2024.

Revenue trend 2019 → 2024

Consequently, the pattern tells a clear story: the sector’s rebound relied on both pent-up leisure demand and reopening of international routes. Moreover, recovery timing varied by region and segment, with leisure-heavy markets typically recovering faster.

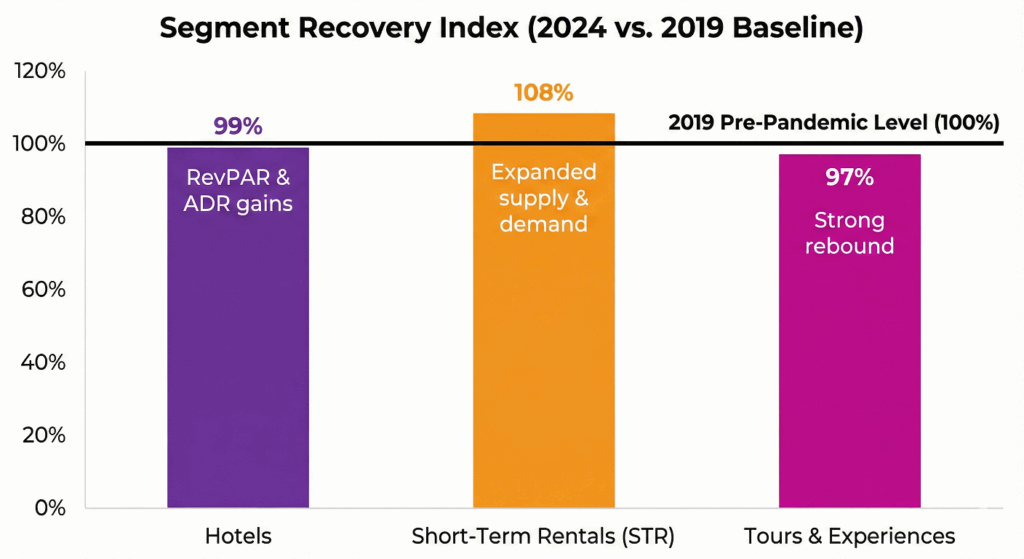

Segment deep-dive

Next, break the recovery down by segment. Hotels saw occupancy and rate gains as travel returned; STR (short-term rental) platforms also expanded nights and guest spending. STR growth boosted local economic activity in many destinations, while hotels benefited from rising ADR in key markets.

Furthermore, STRs often helped disperse demand outside core city centers, supporting restaurants and small businesses. In addition, tours and experiences rebounded strongly as travellers sought richer on-trip activities.

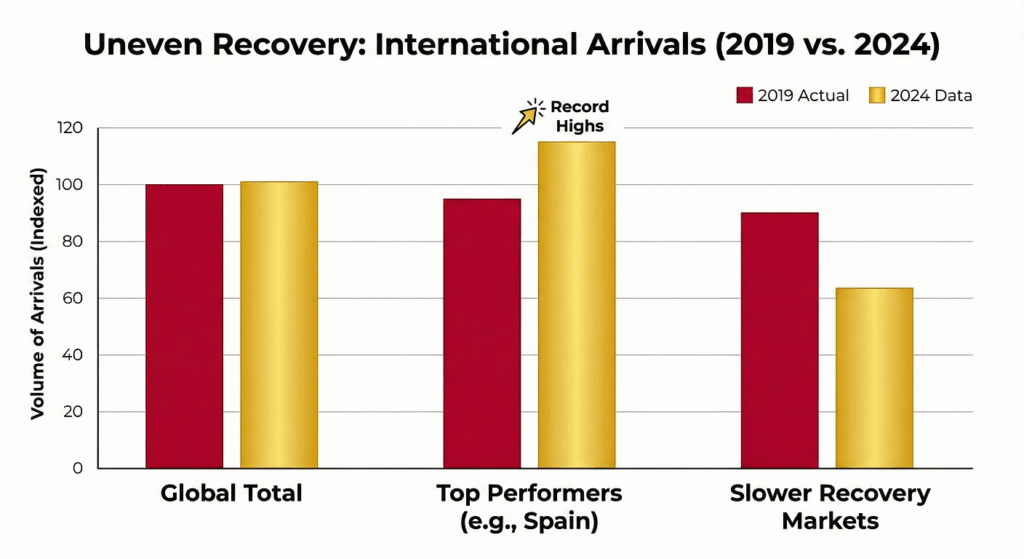

Top-performing countries & laggards

For context, some countries outpaced 2019 levels while others lagged. For instance, Spain hit record arrival numbers in 2024, reporting a very high visitor count and above-2019 receipts. Meanwhile, a few markets still registered slower returns due to connectivity limits or slower business travel recovery.

Therefore, destination performance now depends on a mix of international connectivity, price competitiveness and the strength of domestic tourism.

What the revenue recovery means for businesses

Practically, the rebound changes the playbook for operators. Hotels can justify modest rate increases where RevPAR has recovered, but they must balance price with occupancy risk. Short-term rental hosts benefit from higher demand and the ability to make money online, but should watch local regulation and seasonality.

Moreover, small suppliers — restaurants, guides and transport services — can expect stronger local demand, though they must manage costs in an inflationary environment and plan for staffing constraints.

Methodology & data appendix

Briefly, the headline numbers here come from global industry datasets: WTTC’s Economic Impact Research for GDP and sector totals, UNWTO’s World Tourism Barometer for international arrivals, STR for hotel performance, and platform reports (Airbnb) for short-term rental trends and local economic contribution. I used WTTC’s published 2019–2024 tables and UNWTO’s barometer releases to build the charts.

If you publish these figures, please link to primary datasets and note the access date. Also, my %-recovery calculations use a simple ratio: (year_value ÷ 2019_value) × 100.

Takeaway & recommended next reads

In short, travel and hospitality industry revenue recovered to near or above 2019 revenue levels by 2024, but recovery remains uneven across segments and markets. Consequently, businesses in the hospitality industry should focus on flexible pricing, demand forecasting, and diversifying revenue streams.

For deeper reading, consult WTTC’s Economic Impact Research, UNWTO’s World Tourism Barometer, STR hotel performance reports, and platform economic impact releases (Airbnb). These sources provide the full tables and country breakdowns you can use for follow-up analysis.

Pingback: 5 Reasons Why Booking a Furnished Apartment Beats Staying in a Hotel | Zuru AirBNBs in Kenya